the best pet health insurance for real-life budgets

Peace of mind is priceless, but premiums are not. The goal: protect your pet from big, sudden costs while keeping your monthly spend calm and predictable.

What "best" really means

It's not the fanciest plan. It's the plan that pays most when things go sideways and stays affordable the rest of the year.

- Reliable payouts on big bills: emergencies, surgeries, chronic conditions.

- Transparent exclusions: no guessing about what's not covered.

- Claims you can track: simple, fast, documented.

- Premiums that won't spike overnight: steady enough to budget.

Realistic check: You'll still pay for routine care and exam fees on many policies; insurance shines for the expensive stuff.

Priority order for cost-conscious owners

- Catastrophic coverage first: a plan that caps your worst-case out-of-pocket.

- Deductible you can actually pay: pick an annual amount you can cashflow today.

- Reimbursement rate that moves the needle: 70 - 90% is common; higher costs more.

- Annual limit that matches your risk: aim for a ceiling that covers a surgery plus follow-ups.

- Fair waiting periods and no sneaky exclusions: especially for knees, hips, and hereditary issues.

- Straightforward claims: upload, timeline, status - no mystery.

- Price stability: look for a track record of modest increases, not whiplash.

How the money works

Premiums vary by species, breed, age, location, and choices you control: deductible, reimbursement %, and annual limit. Raising the deductible usually drops the premium more than lowering the reimbursement rate a little.

One quick math pass

Example bill: $4,000 surgery. Deductible $500. Reimbursement 80%. You pay $500 + 20% of $3,500 ($700) = $1,200. Insurer pays $2,800. If the premium difference for a richer plan costs you more than that savings over a few years, scale back.

A quiet real-world moment

Sunday night limp, urgent care. X-ray and meds pushed the bill to $320. I snapped photos of the invoice in the app, got $210 back five days later. Not dramatic, but it kept the grocery budget intact and told me the process actually works.

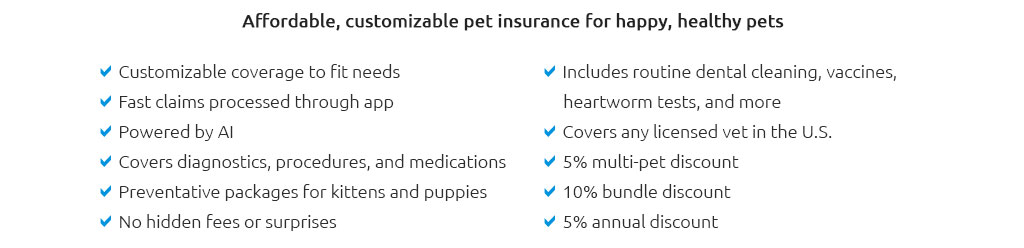

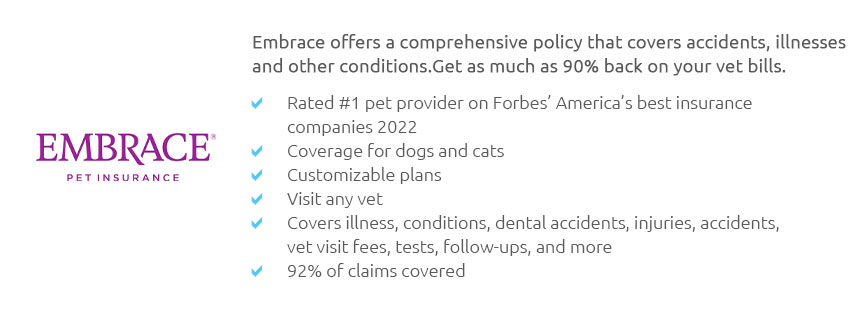

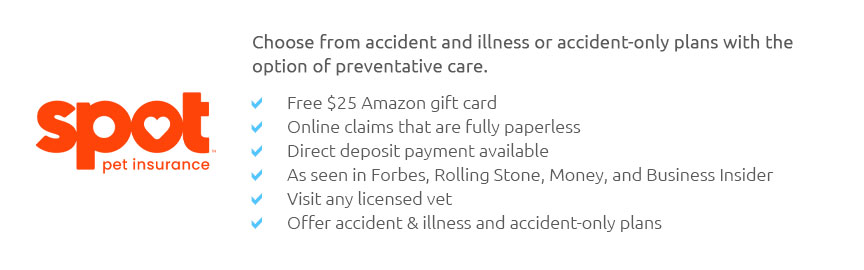

Compare with clarity (no pressure)

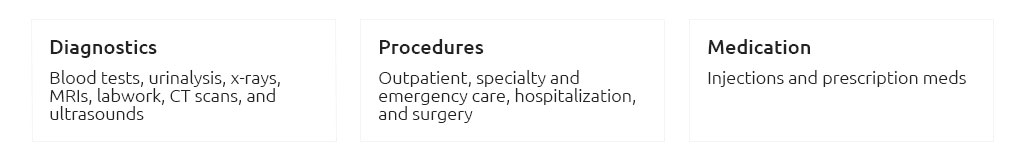

- Coverage scope: accidents and illnesses included? Hereditary and chronic?

- Pre-existing policy: how do they define, and can conditions be cured-out?

- Reimbursement method: percentage of actual vet bill vs. fee schedule.

- Per-incident limits: avoid them if possible; annual limits are simpler.

- Direct pay: any option to pay the clinic directly for large bills?

- Turnaround time: average days to pay a claim - recent, not historic.

Red flags

- Fine print that excludes "bilateral conditions" broadly.

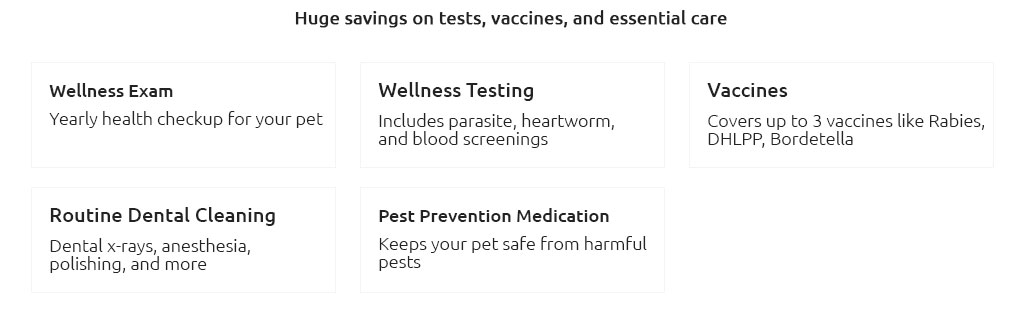

- "Wellness" add-ons that cost more than routine care would.

- Low premiums paired with tiny annual limits.

- Confusing policy wording around "reasonable and customary" fees.

Ways to save without cutting care

- Pick a higher deductible you can cover from an emergency fund.

- Keep reimbursement at 80% if premiums jump steeply at 90%.

- Skip wellness riders; set aside a small monthly preventive-care stash.

- Pay annually if a plan waives monthly billing fees.

- Ask about multi-pet, employer, or alumni discounts.

- Pre-authorize big procedures when possible to avoid surprises.

- Keep records tidy; complete histories reduce back-and-forth on claims.

Trust signals

Clear policy definitions, consistent customer support, and claim examples you can read before enrolling build confidence. A short sample policy is a good sign; buried exclusions are not.

Quick checklist before you enroll

- Emergency goal: "I won't pay more than $X out of pocket."

- Deductible chosen to match your cash cushion.

- Reimbursement % and annual limit tuned to your pet's likely risks.

- No deal-breaking exclusions for breed-specific issues.

- Waiting periods understood - especially for ortho problems.

- Simple claim process with predictable timelines.

The best pet health insurance balances big-bill protection with a premium you barely notice after month two. Prioritize the catastrophes, keep the math honest, and let the policy do the heavy lifting when you need it most.